Understanding China's Yuan Dynamics

Decoding China's Yuan: Recent Developments and Forex Trading Implications

Introduction

China's Yuan (CNY), also known as the Renminbi (RMB), plays a significant role in the global forex market. Understanding the factors influencing the Yuan's movement is crucial for forex traders seeking profitable trading opportunities. In this newsletter, we'll delve deeper into recent developments surrounding China's currency and their implications for traders.

Economic Growth and Policy Decisions

China's economic growth trajectory directly impacts the Yuan's valuation. Traders closely monitor key economic indicators such as GDP growth, industrial production, and retail sales. Additionally, policy decisions by the People's Bank of China (PBOC) regarding interest rates, reserve requirements, and currency interventions significantly influence the Yuan's direction.

Trade Relations and Tariffs

China's trade relations with major partners, particularly the United States and the European Union, have a profound impact on the Yuan. Trade tensions and tariff disputes can lead to volatility in the currency markets. Traders carefully assess developments in trade negotiations and policy announcements for potential trading opportunities.

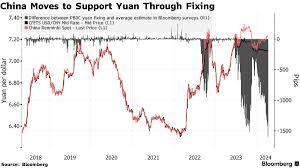

Currency Policy and Exchange Rate Mechanisms

China's currency policy, including its exchange rate mechanism, is closely scrutinised by traders. The PBOC manages the Yuan's exchange rate through a managed float against a basket of currencies. Any adjustments to the currency's trading band or central parity rate can signal the government's intentions regarding exchange rate stability and export competitiveness.

Capital Flows and Financial Markets

Capital flows into and out of China influence the Yuan's exchange rate. Traders monitor developments in China's financial markets, including foreign investment flows, bond yields, and stock market performance. Changes in capital controls, foreign direct investment policies, or market liberalisation measures can impact the Yuan's valuation.

Geopolitical Factors and Internationalisation

Geopolitical tensions and China's geopolitical ambitions can affect the Yuan's perception as a global reserve currency. China's efforts to internationalise the Yuan through initiatives such as the Belt and Road Initiative and the establishment of offshore Yuan centres are closely observed by traders. Geopolitical developments, including territorial disputes and diplomatic relations, can also influence market sentiment towards the Yuan.

Conclusion

Understanding the intricacies of China's Yuan dynamics is essential for forex traders navigating the complexities of the global currency markets. By staying informed about economic indicators, trade relations, currency policies, capital flows, and geopolitical factors related to China, traders can capitalise on opportunities and manage risks effectively when trading the Yuan.

Stay tuned for our next newsletter as we continue to explore macroeconomic trends and their implications for forex trading.