Unwinding Of The YEN Carry Trade

Find out why Japanese investors leave global markets and why narratives are changing.

Good afternoon traders,

Your weekly FX talk where we delve into the fascinating world of foreign exchange and explore the strategies that drive success in the global financial markets. I'm thrilled to have you join us for another thought-provoking discussion.

So buckle up and get ready to expand your knowledge and refine your trading approach, as we unravel the secrets of Carry Trading for Greater Returns

Without further ado… Let’s dive in!

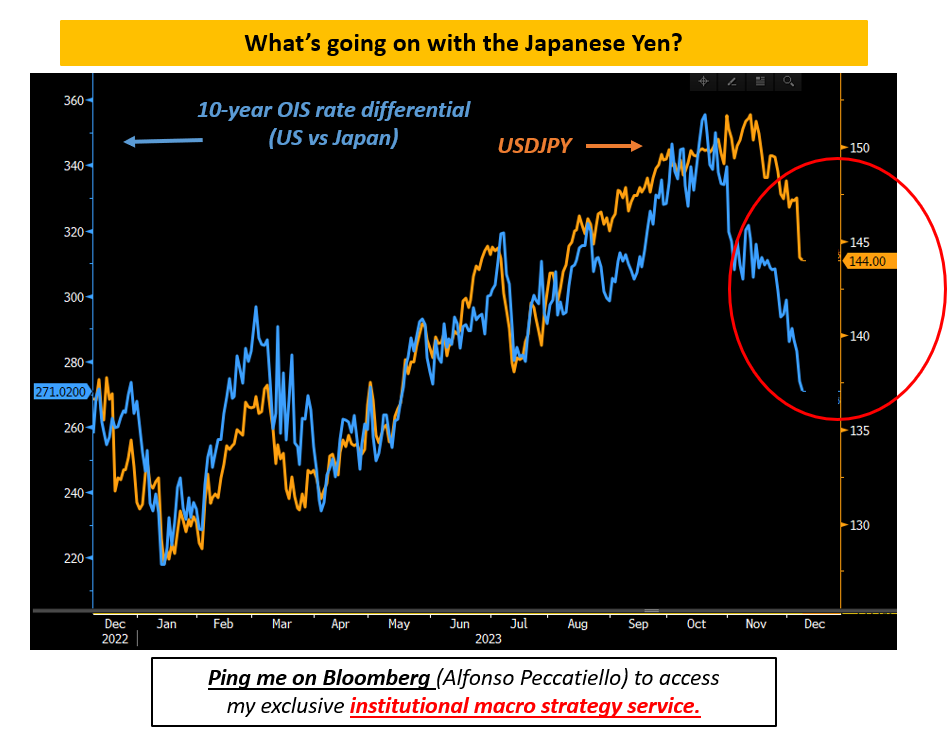

What’s going on with the Japanese Yen?

The outsized moves in JPY and Japanese bond markets have been catching headlines recently - the common narrative is that Japan is finally there to unwind their super easy monetary policy and that pushes yields higher and the Yen stronger.

Evidence says the move in JPY has more to do with something else.

The chart above shows the very tight relationship between 10-year US vs Japan yield differentials (blue, LHS) and USDJPY (orange, RHS): if yield differentials shrink rapidly, the Yen gets a boost.For example, suppose Japanese interest rates are 0% and US interest rates are 5%.

Let’s explain how this trade works

In this case, an Japanese investor can buy Yen and borrow from a Japanese bank at 0% interest. He can exchange Yen for Dollars and put the money in a European bank, gaining 5% interest on his savings. Therefore, in theory, he can make a profit of 5% on the difference between Japanese and European interest rates.

What happens when Europe cut interest rates?

With the Euro economy going into recession, Euro interest rates are falling and could get closer to Japanese interest rates (Japan rates currently 0.3%).

As the gap between European interest rates and Japanese rates narrows, the incentive to borrow in Yen and invest in European banks declines. Therefore, as European interest rates fall, investors are reducing their holdings of Euros and are paying back their borrowings in Yen. This is one reason why the Euro has been falling. Lower interest rates are making people sell Euro investments.

Yen carry trade unwinding

To understand the impact of an unwinding Yen carry trade and its impact on the global economy, it is important to understand why the Yen carry trade occurs in the first place.

For several years Japan has had 0% interest rates. Recently they were increased to 0.5% but, they are much lower than other economies. For example, ECB has had interest rates of 3.5-5%

Japan has very high levels of savings – a pool of $15,000bn. This pool of savings is worth more than the total GDP of the US economy. Japan’s excessive saving contrasts with the excessive spending and borrowing of the US.

Because interest rates in Japan are very low. Japanese investors have been investing overseas. Why save in a Japanese bank and get 0% interest when you could save in Australia and get 6% or Europe and get 4%? Japan has accumulated $6 trillion of foreign assets. As they buy foreign assets it increases the value of foreign currencies such as the dollar

Also many foreign investors, especially American have borrowed in Yen to invest in global stock markets. This is known as the Yen Carry Trade.

The Yen Carry trade is profitable if currencies are stable and / or the dollar is rising against the Yen. If you borrow in Yen and then the dollar falls, you could lose despite the interest rate difference.

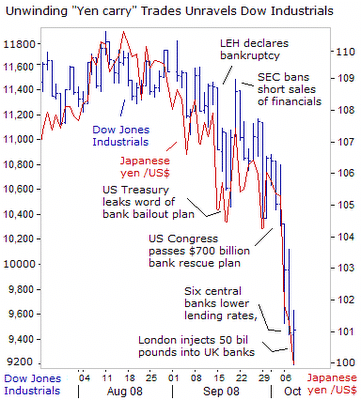

Graph showing appreciating Yen and falling Dow Jones Index

Outflows of Dollar into Yen

No further hikes in the United States, which means people in Japan are less likely or less incline to wanna keep forcing outflows of YEN into Dollar.

Explanation:

So, in Japan we get what’s known as people Carry trade and investors taking money out of Japan, so they borrow money with 0 interest, because yields are very low. Where you don’t pay interest in Japan because they kept interest rates very low. So what they do, they borrow money in Japan for low of no interest and then they go and invest their money into the United States into the economy where they can get yields on their loan.

So basically in simple terms what they do is sell their JPY and convert them into USD. And these trades are coming in line with the rate hikes etc etc.

Speaking of the devil

If we look at the CME FedWatch tool covered in the episode from 2 weeks ago, we see exactly what I described earlier. The possibility of an ease (RATE CUT) in 2024 declined from over 50% to under the 50% mark. Which gives us an indication that the markets are switching narrative on the USD. Unfortunately, the DXY didn’t come to the 101 LVL as I thought, but I still expect the FOMC to push back on those dovish expectations and keep rates higher for longer. Especially if we’re looking at the most recent data, we see that the labour market and average earnings are still hot and resilient.

If you enjoyed this piece I’d love to hear from you in the comments.

Consider sharing this with another macro addict?